Complete financial advice for self-directed investors

Finally there's a financial advisor you can trust - you! No commissions, no conflicts of interest, and no human bias. With access to sophisticated financial models and AI, we'll empower you to do it better yourself.

Continuous Tax Optimization

JP Morgan calculates an additional 1.94% yearly return using monthly continuous tax optimization.7,8

Net Worth Tracking

Visualize all your assets in one platform

Aggregate your net worth and visualize your entire portfolio allocation in a single view, e.g. brokerage accounts, 401Ks, IRAs, crypto, cash, student loans, real estate, private equity, precious metals, and more

Secure connections to 12,000+ institutions

Keep your accounts and all your financial needs safely organized under one roof. Manage your net worth quickly, easily, & efficiently.

Secure connections with 12,000+ banks

Keep your business account and all your finance needs safely organized under one roof. Manage your portfolio quickly, easily & efficiently.

Rely on hedge fund inspired technology

Rely on hedge fund inspired technology

PortfolioPilot is powered by Global Predictions’ award-winning4 technology. Click here to read more about our engine

Graph

ENGINE

Investment Advice

Personalized investment advice with your goals in mind

Optimizing your portfolio is a time consuming job. We'll do the heavy lifting for you and provide specific recommendations.

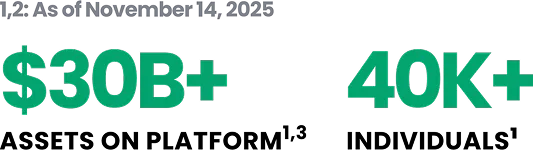

Used by more than 40,000 individuals

We're used by thousands of individuals in the US & Canada, who rely on PortfolioPilot to analyze their portfolios of over $30 billion2,3 in total assets.

Estate Planning & Scenario Modeling

Professional tools now available in an easy-to-use form

Make better investing decisions

Get free 1-min assessmentAdvanced scenario modelling

Test potential outcomes for your investment strategies, and see how different decisions could impact your portfolio over time.

Measure your portfolio strength

Our proprietary engine is a complex multi-layered system which provides portfolio-specific scoring based on your allocation and recommendations influenced by economic models.

Get a free financial assessment →

Identify risks and problem areas

PortfolioPilot monitors the economy and notifies you when risks come up in your portfolio.

AI portfolio assessment that analyzes critical factors

Let our AI wealth manager automatically review your asset allocation, and get investment recommendations based on your specific asset allocation.

Sign up for free →

Estate planning to protect your assets today and tomorrow

Our 360° portfolio management platform can help you make better investment decisions by automatically recommending adjustments on your portfolio to hedge against risks or capture opportunities.

Pricing

98% less than an average financial advisor fee5

PortfolioPilot Free

- Net Worth Tracking. Visualize your asset allocation in a single dashboard.

- Portfolio Analysis. Discover risks and opportunities based on your portfolio.

- Scenario Modeling. Monte Carlo simulations of the past and future.

PortfolioPilot Gold

- Personalized Recommendations. Actionable recommendations based on your portfolio.

- Tax Impact & Continuous Tax-loss Harvesting.

- AI Assistant. Ask questions about your portfolio or anything investing related.

- Fee Visualization. See the fees you pay in one place.

Frequently asked questions

If you need help or have a question that isn't listed below, check out our Help Center or send us an email.

What is PortfolioPilot?

PortfolioPilot, powered by Global Predictions technology, is an AI Financial Adviser that provides investors with hedge fund inspired insights to improve your portfolio and net worth... read more.

Can PortfolioPilot track my entire net worth?

Yes, a part of our offering is comprehensive net worth tracking. PortfolioPilot allows you to track your entire net worth, including securities, real estate, private equity, cash... read more.

How does PortfolioPilot work?

Our system uses comprehensive Recommendation Engine to connect your portfolio and investor preferences with changes in the global economy. The engine is built upon tens of thousands of data streams, providing investors with personalized insights, portfolio simulations, optimization, and risk exposure.

To help investors intuitively understand their performance, we calculate your Portfolio Score by matching your preferred risk with your portfolio, computing your risk-adjusted returns, and analyzing your portfolio's downside protection.

Is PortfolioPilot registered with the SEC with fiduciary responsibility?

PortfolioPilot is a technology product of Global Predictions Inc, a SEC Registered Investment Advisor, with fiduciary responsibility to all its clients. It's also worth noting all information on this website and our platform are for informational purposes only, and that registration does not imply a certain level of skill or training.

Can PortfolioPilot actually give real fiduciary investment advice?

Yes—but only because it’s operated by Global Predictions Inc., a financial advisor registered with the SEC. In the US, you must be registered to legally provide personalized investment advice. Most financial tools can show data or education, but aren’t allowed to make actual recommendations. PortfolioPilot analyzes your portfolio and, under that registration, delivers advice that’s tailored to your situation. SEC registration does not imply a certain level of skill or training.

How is PortfolioPilot related to Diversification.com?

Both platforms are owned by Global Predictions Inc. Diversification.com is our free media hub for market data and education, while PortfolioPilot turns that research into personalized portfolio analysis and AI-driven recommendations.

What’s the difference between the Free, Gold, and Platinum plans?

Free covers core portfolio analysis, scenario modeling, and tracking. Gold adds personalized investment suggestions and tax optimization. Platinum unlocks our most advanced analytics—click the button below for full details.

How much does PortfolioPilot cost?

You can use PortfolioPilot for free with our fully featured free plan. To unlock features such as the personalized recommendations and tax optimization, you can sign up for our Gold plan starting at just $20/mo, and you can cancel anytime.

How does PortfolioPilot use AI?

PortfolioPilot uses a Hybrid-AI approach, it is not just a "ChatGPT wrapper". The personalized recommendations that you see in-product are generated by our Recommendation Engine using hedge fund inspired models for portfolio management. We use machine learning models for forecasting as part of our ensemble models (read more). We also use large-language models as part of our AI Assistant, Easy Portfolio Upload, AI Assessment, and more, all part of our integrated financial advisor experience. Read the "Use of Artificial Intelligence" disclosures section for more detail.

Does PortfolioPilot manage money?

No, you stay fully in control of your own finances. We’ve been focused on building a strong quantitative foundation through data and models, and now applying them to help individuals manage their portfolios. If you are interested in being contacted for potential future product offerings like a fund or a PortfolioPilot Robo-Advisor 2.0 type solution, please reach out to contact@portfoliopilot.com.

How does PortfolioPilot keep my data secure?

We don't sell your data. We use bank-level security to keep your data safe. We have read-only access to any connected accounts to help you stay in control of your finances. Your investments and preferences are used solely for the purpose of generating personalized analytics.

What are PortfolioPilot simulations?

Our simulations feature demonstrates how your selected portfolio would perform through various economic conditions. The system currently supports three scenarios: Dot-com/Tech Bubble, the Global Financial Crisis, and the Covid-19... read more.

How does PortfolioPilot help me?

Our portfolio management system simplifies the complicated investing process to help you try to improve performance while easing your stress. The platform allows you to connect all components of your... read more.

How does PortfolioPilot simulate different investment scenarios?

Currently, PortfolioPilot simulates different investment scenarios by analyzing historical data to model various downside scenarios. This allows you to see how your portfolio might perform during different economic downturns... read more.

Try for free right now

You can get started right now with our 10-day free trial. Get a free financial assessment, and get personalized suggestions in minutes:

Sign up for free