Common Mistake #11: Not Updating Beneficiaries on Retirement Accounts and Life Insurance

Beneficiary designations control how some of the most important financial assets are transferred. Retirement accounts and life insurance policies pass directly to the named beneficiaries on file, often outside of probate and independent of a will. Because of this, outdated beneficiary information can override even well-crafted estate plans.

This article explains why failing to update beneficiaries on retirement accounts and life insurance is a common but high-impact mistake, how the mechanics work, and why the consequences usually surface only after the opportunity to fix them has passed.

Key takeaways

- Beneficiary designations determine who receives retirement and insurance assets.

- These designations typically override wills and trusts.

- Life changes can make old beneficiary choices inaccurate.

- Problems with beneficiary designations often are not identified until assets are distributed.

- Periodic review preserves intent without constant changes.

Why beneficiary designations are easy to overlook

Beneficiaries are usually selected when an account or policy is first opened. At that moment, the choice feels obvious and permanent. Once recorded, the designation rarely affects daily account activity, statements, or performance.

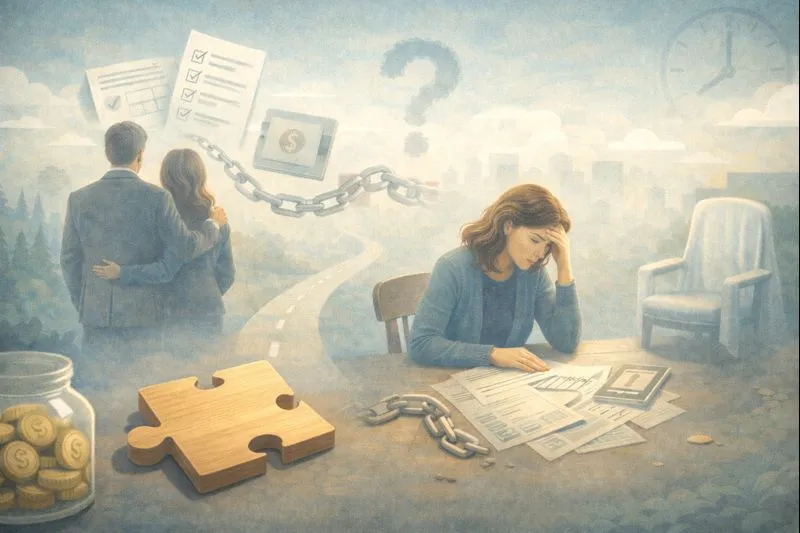

As time passes, priorities shift. Marriages, divorces, children, remarriages, and blended families change who the assets are meant to support. Yet beneficiary forms often remain untouched because nothing appears broken.

From the outside, the account functions exactly as expected. The risk lies beneath the surface.

Where the mechanics create risk

Retirement accounts and life insurance policies follow contractual instructions, not personal assumptions.

In most cases, custodians and insurers distribute assets strictly according to the beneficiary designation on file at the time of death. Courts and administrators generally do not infer intent or defer to a will if a valid designation exists.

This is where the logic breaks. Updating an estate plan does not automatically update beneficiary records. The documents operate independently.

As a result, assets can be distributed according to outdated information even when the broader plan has changed.

How outdated beneficiaries lead to irreversible outcomes

When beneficiary designations are incorrect, the result is not a delay-it is a redirection.

Assets may pass to an ex-spouse, bypass a current partner, or exclude children or dependents entirely. In some cases, distributions occur in ways that introduce unnecessary tax complications or create conflict among heirs.

Because the transfer follows written instructions, correcting the outcome after death is often difficult or impossible. The account holder’s intent, however clear it may have been informally, no longer controls the result.

The consequence appears only at the point of transfer, when no clarification can be made.

Why the problem often remains hidden

Beneficiary errors do not affect balances, returns, or account operations. There is no performance signal, no warning notice, and no visible discrepancy.

Many people also assume that updating a will or trust updates everything associated with it. In reality, beneficiary designations must be changed at the account or policy level.

This disconnect allows outdated instructions to persist quietly for years, even as financial plans evolve.

A more durable way to think about beneficiaries

Investors who avoid this mistake tend to adopt a simple reframing:

Beneficiary designations are living instructions that should match current intent.

This does not require frequent changes or constant oversight. It means recognizing that major life events can alter whose assets are meant to benefit - and ensuring that account records reflect that reality.

The goal is alignment. Beneficiary designations should reinforce the plan, not undermine it.

When leaving beneficiaries unchanged may be intentional

There are situations where beneficiary designations remain appropriate for long periods. Some investors intentionally maintain specific beneficiaries for tax planning, legacy goals, or family reasons.

The distinction lies in awareness.

Leaving beneficiaries unchanged by choice is different from leaving them unchanged by default. The mistake is not stability-it is misalignment between intent and documentation.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now:

.webp)