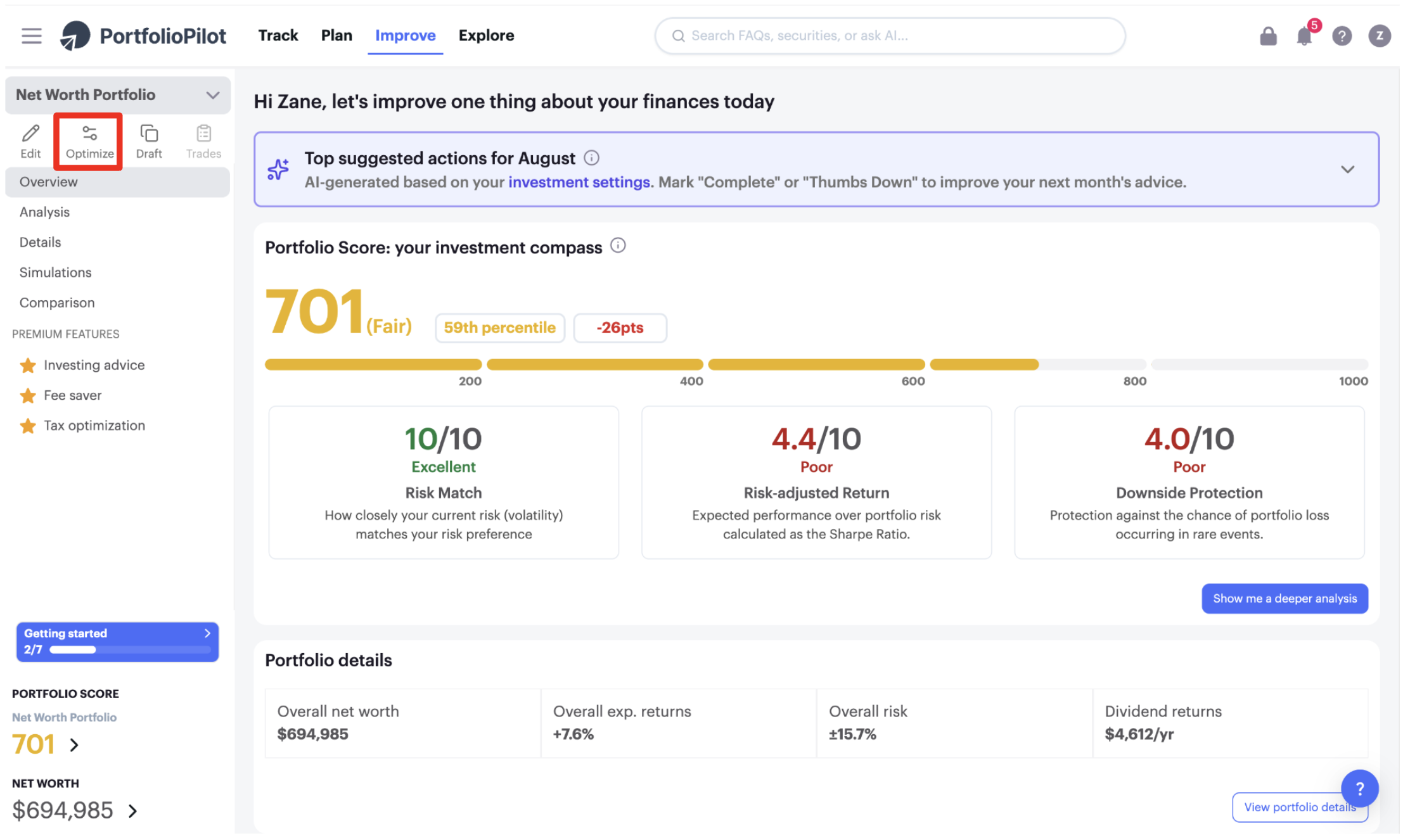

Tutorial: Portfolio Optimizer

Note: Specific investments described herein do not represent all investment decisions made by Global Predictions. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.

Enjoy this short tutorial on how to use the Portfolio Optimizer, an easy-to-use powerful tool to automatically help you improve your risk-adjusted expected returns.

Using the Portfolio Optimizer

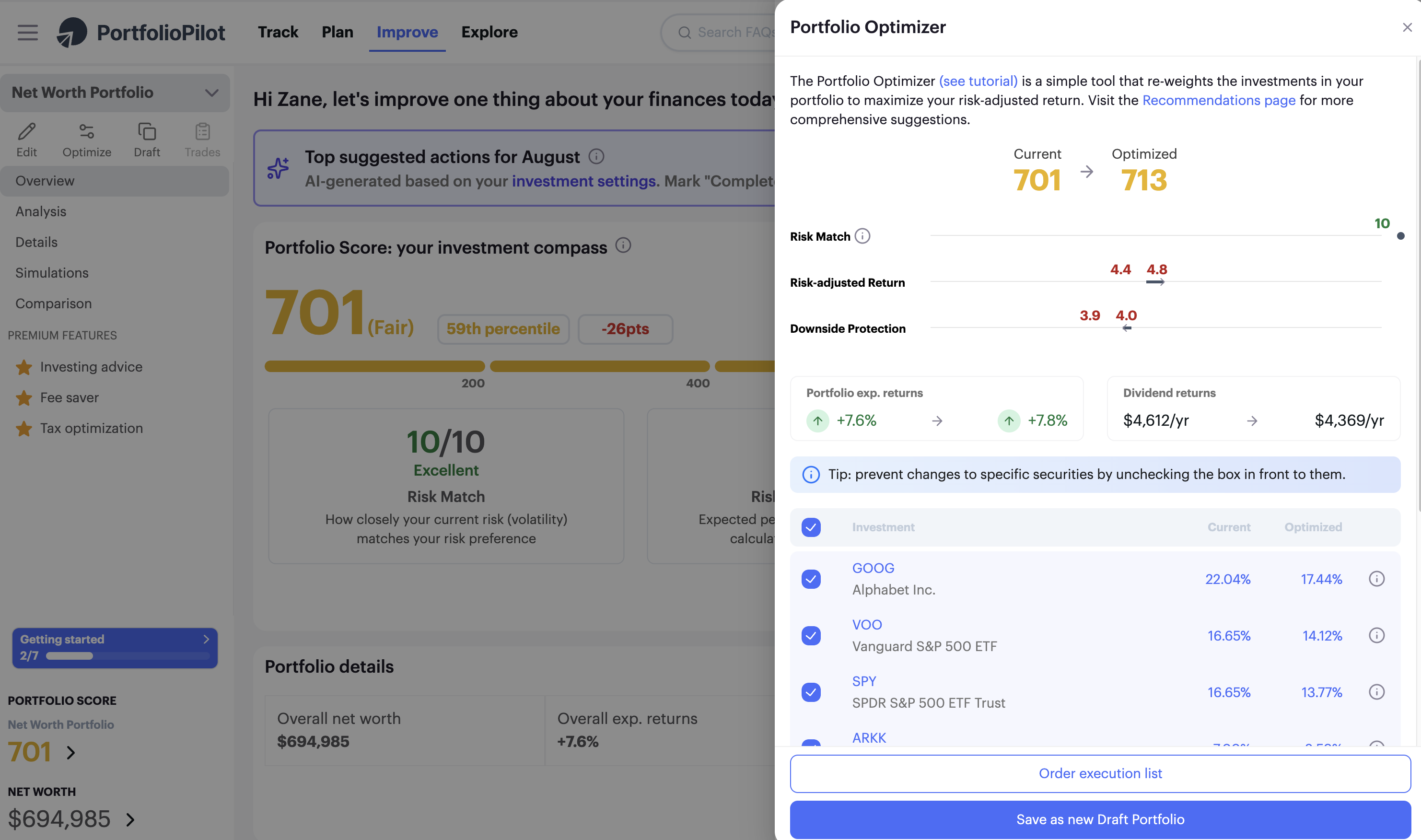

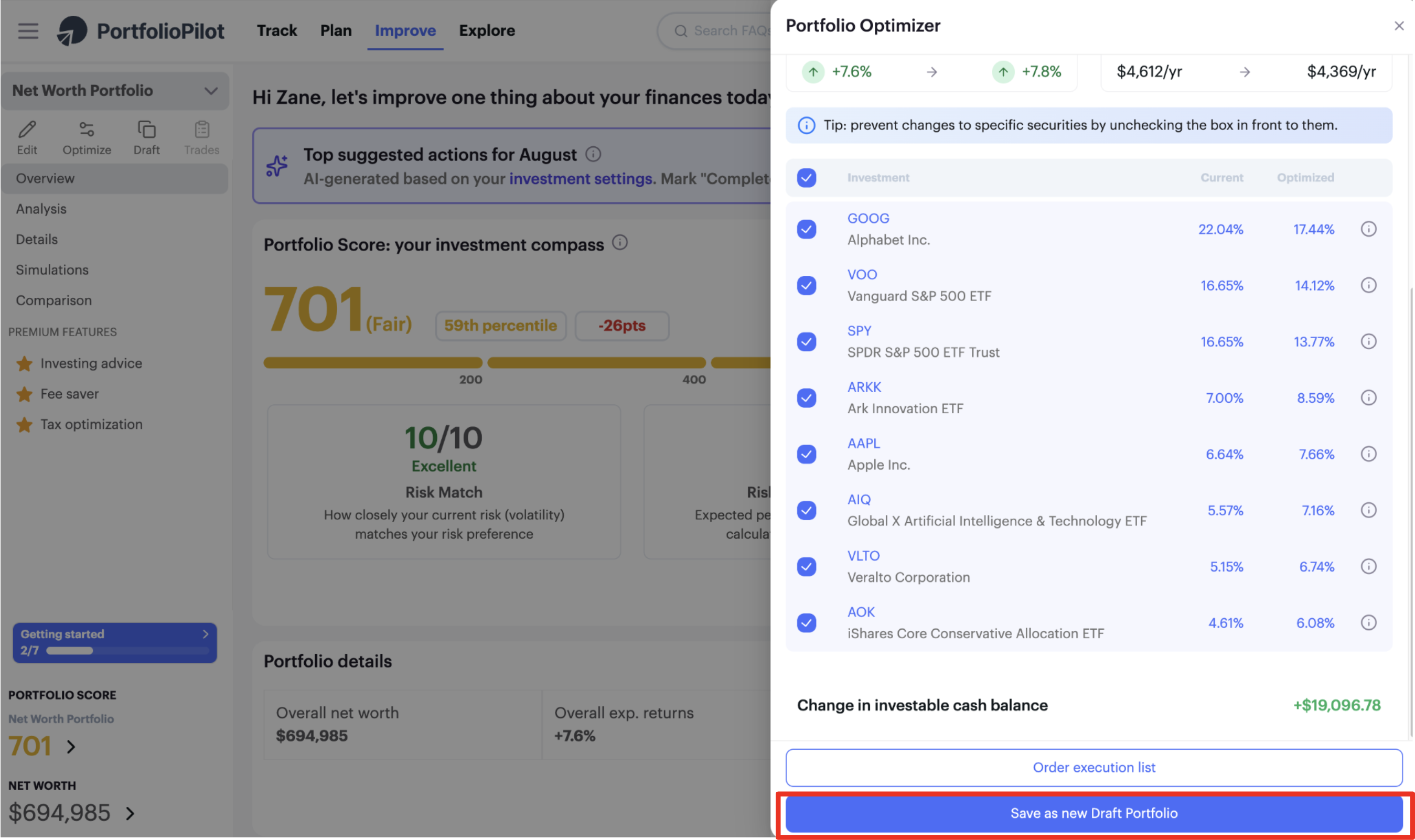

The Portfolio Optimizer re-weights the investments in your portfolio to maximize your risk-adjusted return while matching your risk preference. In the background, it uses Modern Portfolio Theory to try to calculate an "Efficient Frontier" for your portfolio, effectively re-weighting your portfolio in thousands of ways, searching for the best possible composition along this frontier (if possible). It's an extremely simple, expert tool that you can use to balance the securities within your portfolio to optimize the expected risk-adjusted returns. You can also unselect individual securities if you do not wish for them to be affected by the Portfolio Optimizer tool.

Note: the Portfolio Optimizer will also take into account the other Net Worth items within your portfolio like cash, real estate, and crypto.