Tutorial: Portfolio Score

Note: Specific investments described herein do not represent all investment decisions made by Global Predictions. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.

Learn how to use the Portfolio Score and Analysis page to help try to better your portfolio. Happy investing!

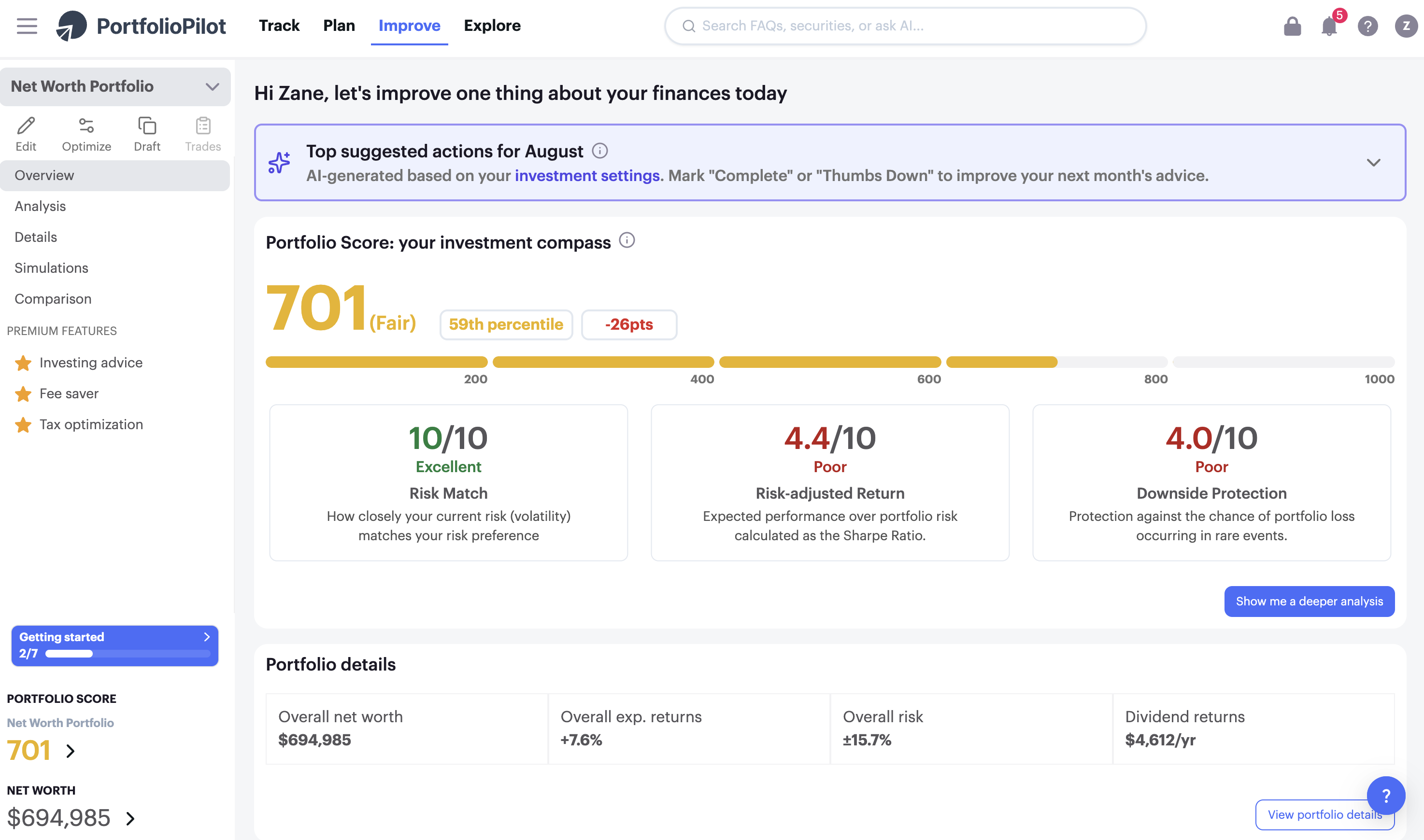

Portfolio Score

The Portfolio Score is a quick way to understand how your portfolio is doing. This score combines your personal investment preferences, risk & returns, and macro exposure as a guide for portfolio improvement.

The three components of the Portfolio Score are:

- Risk Match - Current portfolio risk compared to your preferred risk profile

- Risk-adjusted Return - Expected performance over portfolio risk (calculated as the Sharpe Ratio)

- Downside Protection - Protection against possible scenarios of extreme stress and other sources of uncertainty (i.e. tail risk)

See the Portfolio Score and its component at the top of the Overview page:

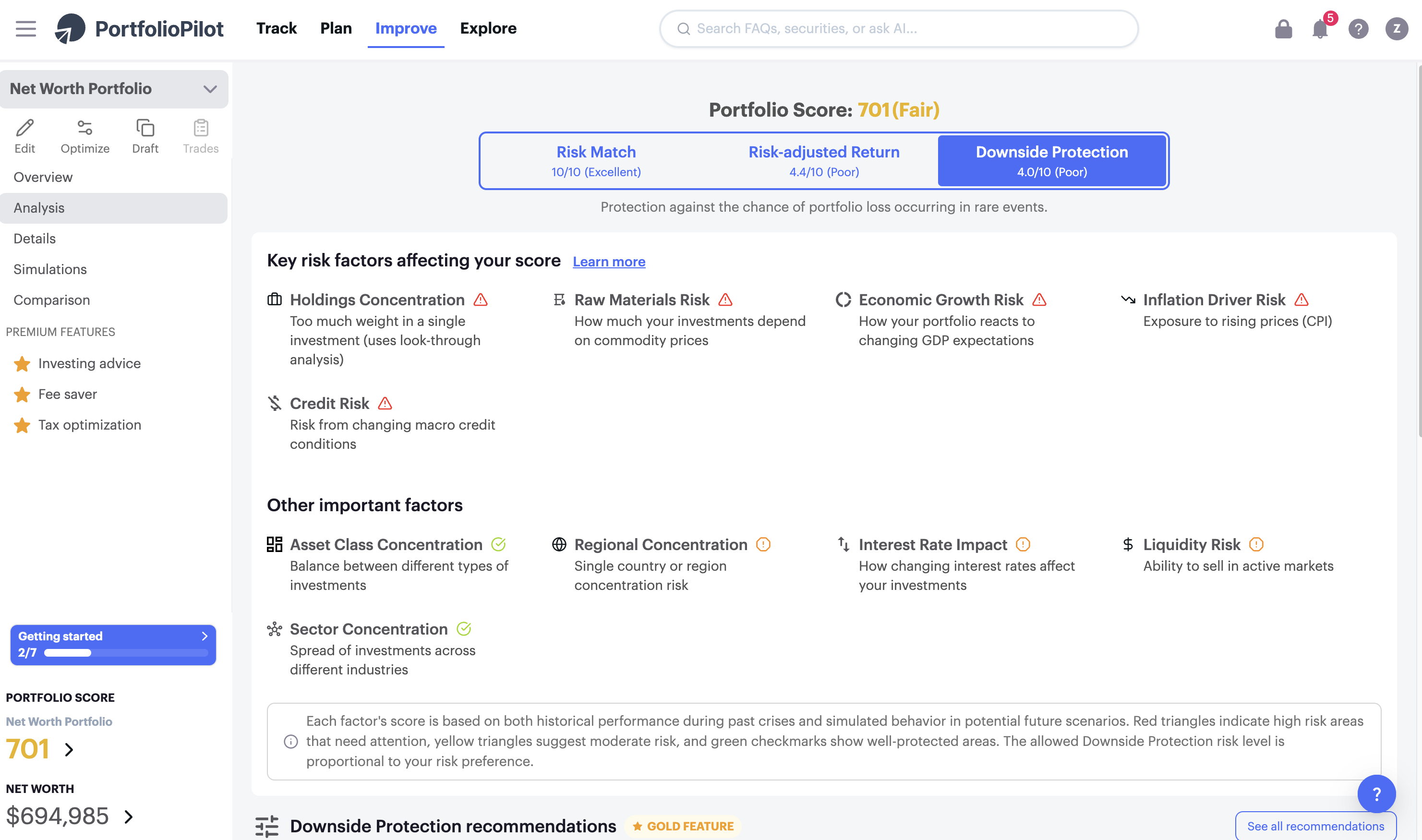

Or go to the Analysis page to get an in-depth look at how each of the components of your Score are calculated:

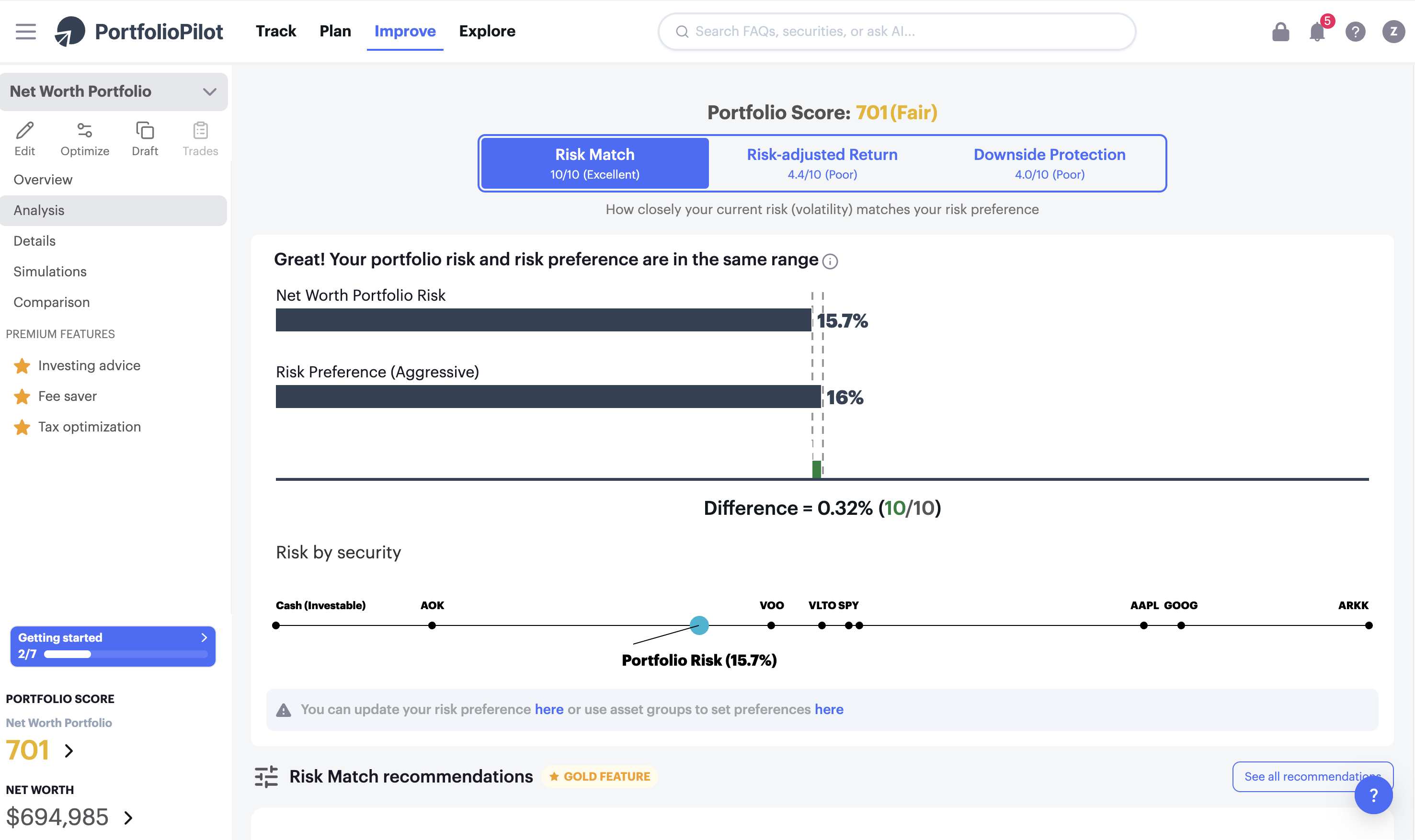

Risk Match Score Component

The Risk Match measures your current portfolio risk compared to your preferred risk profile. The closer the match, the higher the Risk Match Score component. It very important to make sure that you are not taking more or less risk than you are comfortable with, as your risk preference is crucial to portfolio management. Note: as markets move your portfolio's risk will change, one of the main reasons to rebalance your portfolio periodically.

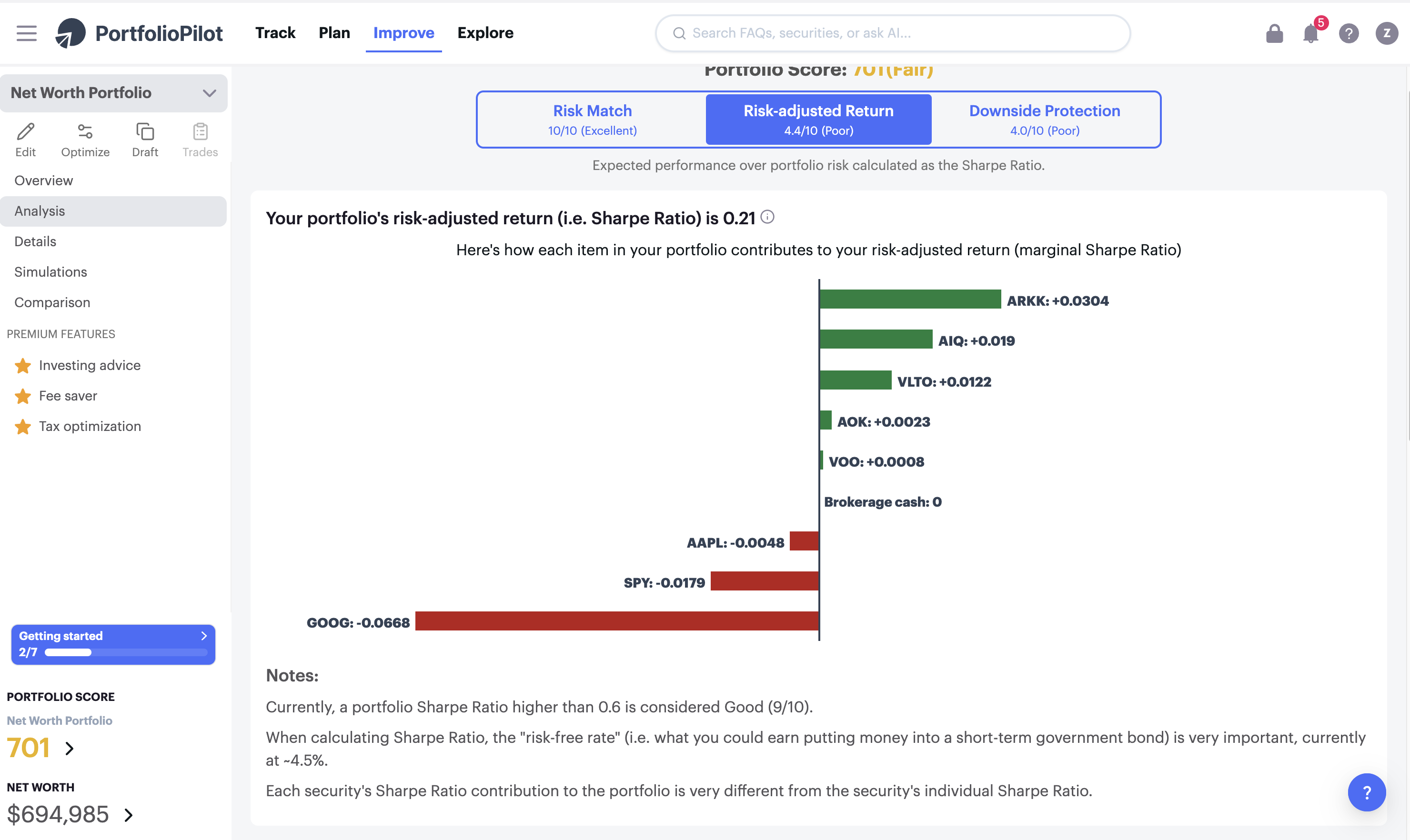

Risk-adjusted Return Score Component

Risk-adjusted return is the expected performance over portfolio risk (calculated as the Sharpe Ratio). This means the overall expected performance (weighted-sum over all the individual securities) divided by the overall portfolio volatility (non-linear combination of all the individual security volatilities).

It is worth optimizing how all the securities in your portfolio fit together, as you will be able to get dramatically better overall returns if you think about your portfolio as an interconnected puzzle rather than a set of individual securities. It's useful to hold a set of uncorrelated securities so that all your investments don't rise and fall at the same time. The Risk-adjusted Return tab shows the marginal contribution of each security in your portfolio to the Sharpe Ratio, making it easy to see how each investment contributes, given the rest of the current portfolio.

Downside Protection Score Component

Risk comes in many different forms. This last tab measures your protection against possible scenarios of extreme stress and other sources of tail risk. Ultimately, its worth measuring your portfolio's influence to various macroeconomic drivers so that you can neutralize external threats (whether you see them coming or not). This part of the system helps you keep a truly diversified portfolio, spread out across countries, sectors, asset classes, and also protects against surprises in inflation, GDP growth, credit conditions, market liquidity, commodities, and interest rates.