Innovations in Financial Portfolio Optimization

.webp)

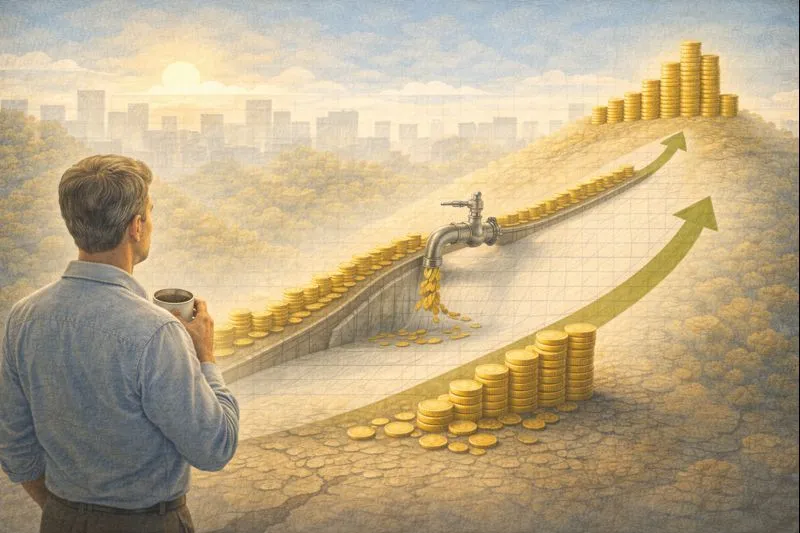

This article is designed for investors looking to stay ahead in the ever-changing financial landscape, offering insights into how innovative tools and strategies are shaping the future of portfolio management. Whether you're an experienced investor or just starting, portfolio optimization plays a key role in managing investments to enhance returns and mitigate risk. In this article, we explore recent trends and forward-thinking approaches that are influencing portfolio optimization today.

The Impact of AI on Portfolio Management

Artificial intelligence (AI) is transforming numerous industries, including finance. In portfolio management, AI processes large datasets to identify risks and opportunities that human analysts might overlook. More than just a computational tool, AI aims to assist investors by providing insights based on complex data patterns and forecasts.

For example, an investor holding a mix of stocks and cryptocurrencies can use AI-driven tools to analyze market data and suggest reallocations to lower-volatility assets during periods of instability, helping to reduce potential losses. While such tools offer valuable insights, investors should always consider their individual circumstances or consult with a professional.

Diversified Asset Integration

Modern portfolio optimization platforms allow for the integration of various asset types—including real estate, cryptocurrencies, and private equity—into a unified portfolio view. This expanded integration helps investors understand how changes in one area may impact their broader financial landscape.

For instance, an investor with exposure to both real estate and equities can use these tools to visualize how an economic downturn might affect different asset classes. While equities might experience volatility, real estate could offer more stability, providing a balance within the overall portfolio. This holistic view allows for better risk management, particularly with less conventional asset types that are becoming more common in investment portfolios.

Simulating Market Downturns and Managing Risk

A key feature of modern portfolio management platforms is the ability to simulate market downturns, which enables investors to model how their portfolios might perform during various crisis scenarios. These simulations offer insights into the resilience of their investments, helping them make more informed decisions.

For example, an investor might simulate a recession scenario and discover that their portfolio, heavily weighted in technology stocks, may be more vulnerable than they anticipated. This insight could lead them to adjust their allocations, potentially reducing risk during market declines.

Improved Fee Transparency and Management

Understanding and managing investment fees is crucial for maximizing net returns. Modern platforms offer detailed fee visualizations, showing investors exactly where their money is going. This transparency encourages cost-effective investment choices and may uncover opportunities to reduce fees without compromising quality.

For instance, investors can visualize how fees from various investments affect their overall returns, allowing them to identify higher-cost investments that may be detracting from long-term financial goals.

A Shift Toward Personalized Investment Strategies

Advancements in machine learning and data analysis are making personalized investment strategies more accessible. These tools can tailor recommendations based on individual financial goals, risk tolerance, and even behavioral tendencies.

For example, an investor with a conservative risk profile may receive suggestions to focus on more stable assets such as bonds or dividend-paying stocks. In contrast, a more aggressive investor might be guided toward higher-risk assets such as private equity or cryptocurrencies. This level of personalization, once exclusive to private banking, is now becoming more widely available thanks to technological advancements.

Looking Ahead in Portfolio Optimization

Looking forward, we expect even greater integration of AI and machine learning in portfolio optimization tools, potentially offering more tailored insights. The distinction between financial guidance and technology may continue to blur as these tools evolve, offering solutions that align with both strategic actions and the individual investor's financial journey.

For example, future developments could enable AI-driven platforms to analyze global events and dynamically adjust recommendations, helping investors take a more proactive approach to managing their portfolios. While these innovations present exciting opportunities, investors should remain mindful of their personal financial situations and the importance of maintaining a diversified approach to investments.

By staying informed and adopting these innovations, investors can potentially transform how they manage their financial futures. Portfolio optimization tools are demonstrating how technology is making sophisticated investment strategies more accessible to a wider audience.

As the financial landscape continues to evolve, investors can look forward to gaining even greater control over their financial paths, reinforcing the idea that the future of finance is not just about managing money—but about maximizing potential.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: