Multi-Period Asset Allocation: Why It Matters

Over a 30-year period, failing to adjust your investments could mean taking on too much risk at the wrong time or missing out on massive growth opportunities. A study by Fidelity found that a non-rebalanced portfolio had 16% more volatility without delivering better returns. In other words, staying passive could be costing you money and adding unnecessary stress.

That’s where multi-period strategic asset allocation comes in. Instead of a rigid, set-it-and-forget-it approach, this strategy adapts as markets shift and your goals evolve. Because the truth is, investing isn’t a straight line, and your portfolio shouldn’t be either.

If you're serious about maximizing returns while managing risk, it's time to rethink how you allocate your assets. Let’s dive into the smarter way to build a long-term, adaptable investment strategy.

Key Takeaways

- Traditional asset allocation assumes static portfolios, but real-world investing requires ongoing adjustments.

- Multi-period allocation considers market cycles, personal financial changes, and shifting return expectations.

- Dynamic allocation helps optimize risk-adjusted returns by responding to changing economic conditions.

- A long-term strategy should evolve as your wealth grows and risk tolerance shifts.

The Problem with One-Time Asset Allocation

Many investors believe that setting an allocation is enough. But, this ignores how market risks and returns change over time.

Hypothetical Example: Imagine you’re 40 years old with a portfolio of 70% stocks and 30% bonds. That mix might be fine now, but what if, in 10 years, stocks become overvalued or interest rates spike? Sticking to the same allocation could mean unnecessary risk or poor returns.

With a multi-period approach, you’re not locked into a fixed strategy—you adapt as markets and personal circumstances change.

Why Many Investors Stick to Static Allocations

Despite its flaws, traditional static allocation remains popular because it’s simple. Many fund managers and robo-advisors promote it because a single number is easy to understand and compare against. However, real investing is often far more complex. Failing to adjust your portfolio means you could take on too much risk at the wrong time or miss key growth opportunities.

How Multi-Period Asset Allocation Works

Instead of relying on a fixed strategy, a multi-period approach adjusts based on:

- Market Cycles & Economic Conditions – Asset valuations, inflation, and interest rates shift over time.

- Personal Financial Goals & Risk Tolerance – Your needs at 30 aren’t the same as at 60. As retirement nears, reducing risk may become a priority.

- Investment Horizon – Younger investors can take more risks, while those nearing retirement may need a more stable allocation.

Key Concept: Dynamic Optimization

Unlike static models, multi-period asset allocation continuously adjusts based on changing market conditions, balancing risk and expected return. This approach allows investors to optimize their portfolios dynamically as new information emerges.

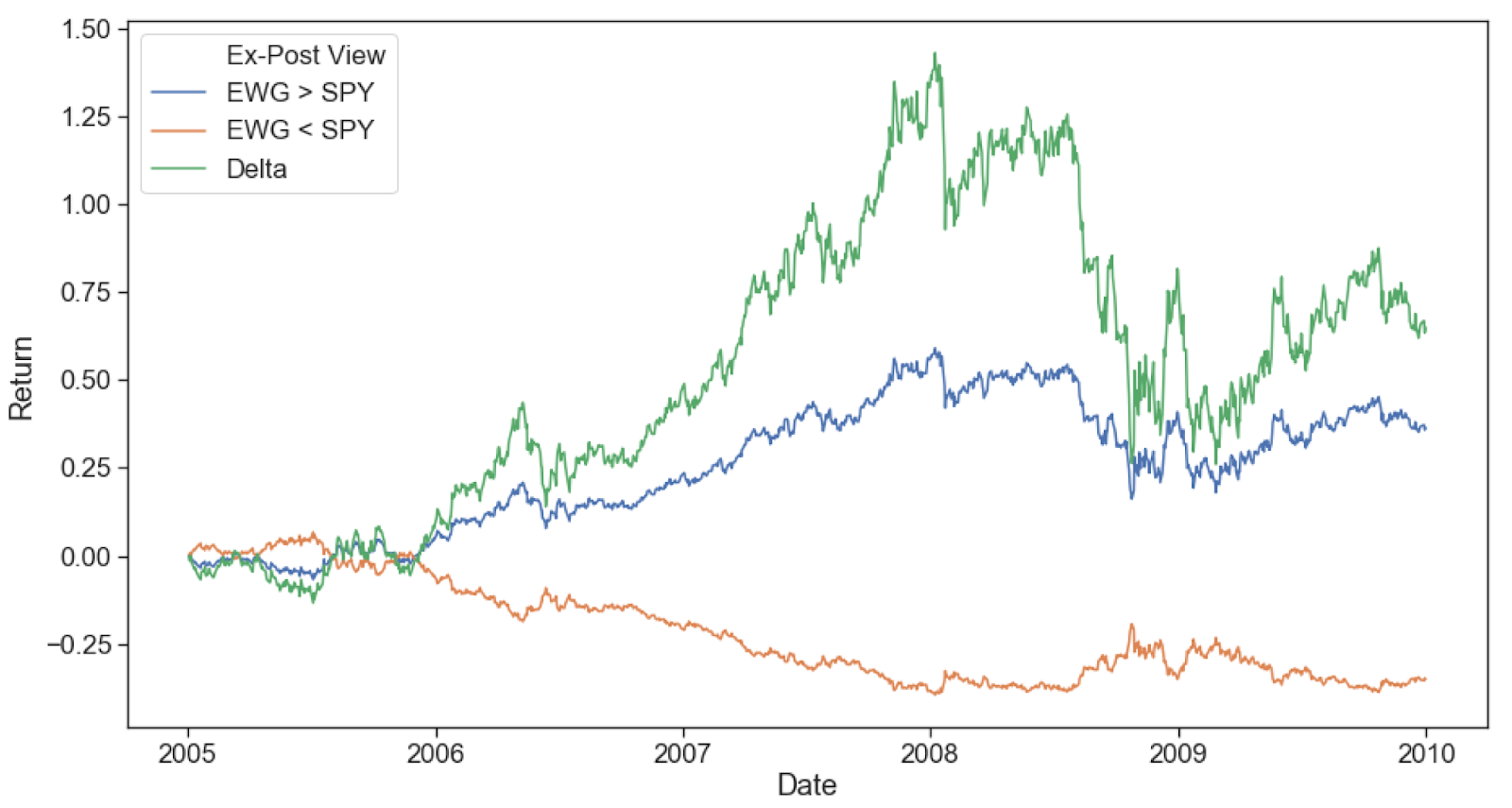

A practical example of this concept is illustrated in the study "Multi-Period Portfolio Optimization with Investor Views under Regime Switching" (MDPI). The chart below, titled "Example View Returns (2005–2009)", showcases how different portfolio allocation strategies evolve over time, emphasizing the importance of adaptability in multi-period investing.

- Blue Line (EWG > SPY): Represents periods where the EWG ETF (German market) outperformed the SPY (S&P 500).

- Orange Line (EWG < SPY): Indicates periods where the EWG underperformed relative to the SPY.

- Green Line (Delta): Shows the cumulative difference between EWG and SPY returns, highlighting the benefits of a dynamic allocation approach based on market shifts.

This multi-period allocation model benefits from the flexibility to rebalance portfolios as market conditions change, using forecast-driven regime-switching strategies. By integrating approaches such as the Black-Litterman model and dynamic confidence adjustments, portfolio managers can optimize allocations quantitatively rather than relying solely on subjective forecasts.

The key takeaway from this study is that continuously adapting a portfolio—by making adjustments based on new data and evolving market environments—can significantly enhance long-term performance while reducing reliance on static investment assumptions.

The Risks of Ignoring Multi-Period Allocation

If you rely on a static allocation, you may face serious downsides:

- Increased Risk at the Wrong Time – Holding too many stocks near retirement could mean major losses just before you need your money.

- Missed Market Opportunities – A rigid allocation might prevent exposure to emerging asset classes or economic trends.

- Tax Inefficiencies – A flexible approach allows for tax optimization strategies, improving after-tax returns.

Strategies for Implementing Multi-Period Allocation

- Regularly Review Your Portfolio – Instead of rebalancing on autopilot, reassess based on economic conditions and personal milestones.

- Consider Market Trends – Use economic indicators to anticipate risks like inflation spikes or downturns, and adjust accordingly.

- Diversify Beyond Stocks and Bonds – Alternative assets like real estate and commodities can help reduce reliance on traditional portfolios.

- Optimize for Taxes – Keeping high-tax assets in tax-advantaged accounts and using tax-efficient strategies can improve long-term returns.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: