Python for Advanced Financial Analysis: Portfolio Optimization Case Study

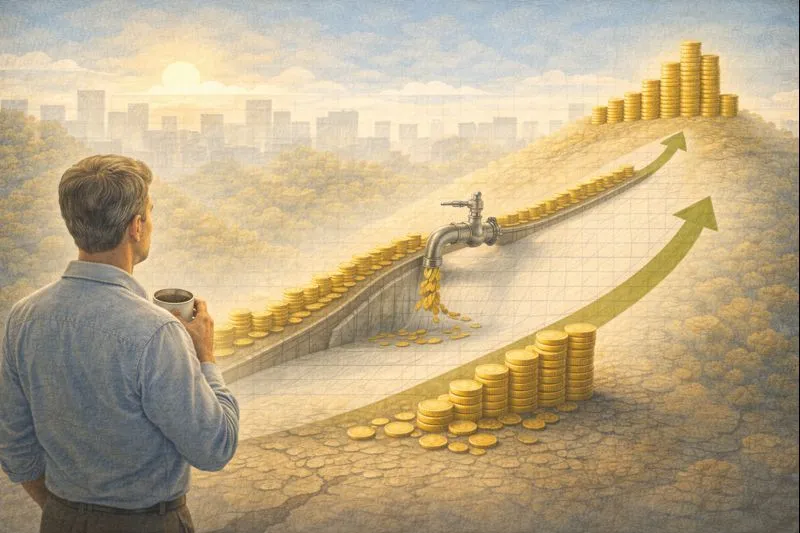

In the realm of investment management, maximizing returns while maintaining an acceptable level of risk is an art. One that's increasingly guided by technological advancements, particularly through the strategic use of software languages like Python. Here, we explore how Python can be used to create a portfolio optimization system, a practice crucial for informed decision-making in finance.

What is Portfolio Optimization?

Portfolio optimization is a strategic endeavor aimed at determining the best asset mix to achieve desired returns, given a certain level of risk and market unpredictability. This practice, deeply rooted in Modern Portfolio Theory (MPT) introduced by Harry Markowitz in the 1950s, focuses on constructing an "efficient frontier" to achieve optimal asset allocation.

The Integral Role of Python in Financial Analysis

Python's simplicity and the powerful suite of libraries it offers—such as Pandas for data handling, NumPy for numerical operations, and SciPy for scientific computing—make it a preferred choice in the toolkit of some financial analysts. These libraries support complex data analysis and optimization processes that are crucial for portfolio management.

A Closer Look: Using Python for Effective Portfolio Management

Consider a scenario where an investor aims to distribute their capital across a selection of stocks to optimize the risk-return trade-off. Here’s a conceptual overview of how Python can be exploited effectively:

- Data Collection: Pandas efficiently handles large datasets, allowing analysts to obtain and manage historical stock prices and other financial metrics from diverse sources.

- Risk and Return Calculation: Python capabilities can be used to enable the detailed computation of expected returns and the risk profiles for different assets, providing it the data needed to assess potential investment combinations.

- Optimization Techniques: Tools like the PyPortfolioOpt library provide functions for portfolio optimization, which include calculating the maximum Sharpe ratio. It's important to note that while the Sharpe ratio is a well-recognized risk-adjusted performance measure, like all metrics, it relies on historical data that does not necessarily predict future performance. These tools help identify the most efficacious asset weights under various market conditions.

- Scenario Analysis: you could use Python to support simulation and forecasting techniques, which may allow analysts to explore how different portfolio configurations could behave under varied economic scenarios, depending on specific circumstances.

Advantages of Python in Portfolio Optimization

- Tailored Strategies: using Python allows for the creation of customized investment strategies that can adapt to an investor’s specific risk tolerance and goals.

- Analytical Tools: Using Python libraries, coupled with modern portfolio theory applications, provides a more granular insight into potential investment outcomes, allowing for more refined decision-making.

Closing Insights on Financial Analysis and Portfolio Management

Though Python and it's libraries offers significant advantages in analytics, any tool or technique is only part of the broader strategic framework that includes a deep understanding of market trends and investor behavior. Integrating tools like these is similar to what is offered by PortfolioPilot — which utilizes a comprehensive financial insights engine — using this investors may gain additional resources that could contribute to a more informed understanding and management of their portfolios, depending on their effective use of the available tools.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: