Understanding Real Estate Portfolio Loans

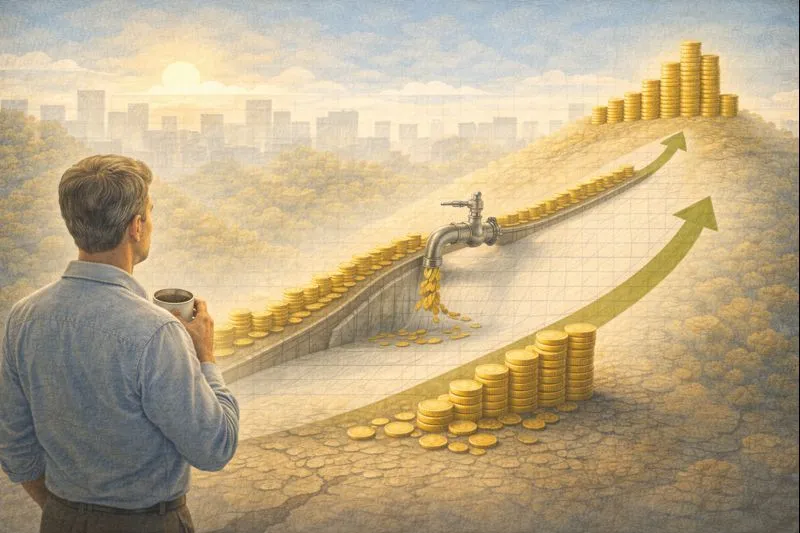

Real estate investment is a critical component of many investors' portfolios - and just gets more fun as you move beyond one property. Adding leverage through portfolio loans can open up numerous opportunities for growth and diversification beyond just traditional mortgages. What exactly are real estate portfolio loans, and how does their mechanism function within portfolio management? Let’s explore.

What is a Real Estate Portfolio Loan?

A real estate portfolio loan is a type of financing that permits investors to borrow against multiple properties simultaneously. This financing method is particularly advantageous for investors who own multiple properties and aim to manage their finances more efficiently. Rather than maintaining separate mortgages for each property, a portfolio loan consolidates them into a single loan, potentially simplifying the management process and reducing loan servicing costs.

The Benefits of Portfolio Loans

- Diversification: Consolidating loans allows investors to spread their investment risk across several properties.

- Flexibility: Portfolio loans typically offer more adaptable terms compared to traditional single-property loans. This can be crucial for investors looking to expand their portfolios without the constraints imposed by stringent borrowing terms.

- Efficiency: Managing a single loan for multiple properties can be less taxing and less costly than handling several separate mortgages.

How Portfolio Loans Impact Investment Strategies

Integrating portfolio loans into an effective investment strategy can significantly alter an investor's approach to portfolio management.

Expanding Investment Horizons

With the additional funding from a portfolio loan, real estate investors might explore purchasing properties in new geographical locations or different types of real estate, such as commercial properties or larger residential complexes. This expansion can be beneficial for diversifying investment holdings and potentially enhancing returns.

Enhancing Cash Flow Management

Portfolio loans can also improve cash flow management by offering potentially lower aggregated monthly payments. This enhanced cash flow provides the liquidity needed for property maintenance, property taxes, or investments in property enhancements that could augment rental income.

Considerations and Risks

While the benefits are clear, there are risks associated with real estate portfolio loans, such as increased debt levels, leverage, and more complex loan structures. Valuing assets isn't always straightforward. Whether it’s real estate, stocks, or even unconventional comparisons — like determining how many camels you're worth — the key is understanding what factors drive that valuation. It’s vital for investors to carefully assess their financial situation and investment objectives when considering these loans.

Example of Strategic Use:

Consider Jordan, a hypothetical investor with multiple rental properties. Previously managing four different mortgages with varying interest rates and terms, Jordan consolidated these properties under one portfolio loan with a uniform rate and a single renewal date. This not only simplifies Jordan's financial management but reduced his overall interest payments through better negotiated terms due to the aggregated property value and lower overall risk to the bank.

Enhanced Portfolio Management with AI-Driven Platforms

In the evolving landscape of real estate investment, utilizing intelligent platforms may potentially assist in managing investment portfolios. An AI-driven tool like PortfolioPilot could provide analytics and insights, which might help in making more informed decisions based on data modeling and economic forecasts.

Such tools can simplify the management of diverse investments, including those backed by real estate portfolio loans. They aid in monitoring performance, aggregating financial data across properties, and providing insights leading to more informed decision-making.

For investors with diverse and multifaceted portfolios, integrating a user-friendly yet comprehensive tool is crucial. It reduces the complexity of analytics and offers personalized recommendations, allowing for more focused strategic decision-making.

Leveraging platforms that integrate analysis and personalized insights serves as an vital resource, steering investment strategies and improving the management of financial portfolios, setting the stage for potentially more successful real estate investments.

Looking Forward: The Future of Real Estate Portfolio Loans

As the real estate market evolves, the financing options available to investors are also likely to change. Real estate portfolio loans will likely continue to be a vital tool for many investors aiming to scale their operations and manage their investments effectively. As technology in financial modeling and analysis progresses, platforms that offer insights and tools could be useful in helping investors navigate transitions, potentially informing more data-oriented strategic decisions.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: