Unlocking Efficiency: Advanced Strategies for Portfolio Optimization

.webp)

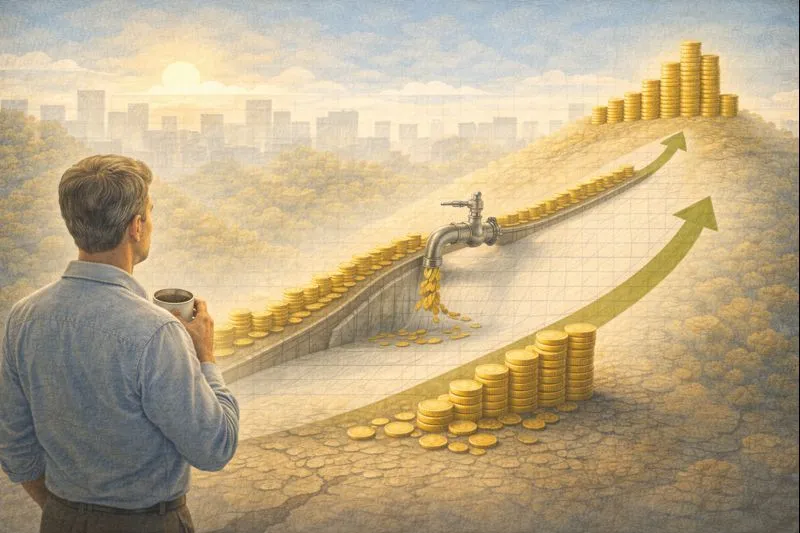

Investing intelligently is an art that requires a thoughtful combination of strategy and execution, and important to this is portfolio optimization. Within this guide, we'll explore the nuanced strategies that can enhance your portfolio's efficiency, embracing innovative tools like PortfolioPilot to navigate these complex financial waters effectively.

The Art of Portfolio Optimization

Portfolio optimization isn't just about spreading your investments across the board; it's an approach that balances risk against expected returns. Through advanced mathematical models and simulations, even average investors can forecast potential outcomes, enabling strategic adjustments that align with specific financial goals. This process is about fine-tuning your investment mix to maximize returns while managing risks intelligently.

Enhanced Strategies for Optimal Performance

- Strategic Asset Allocation: Imagine portfolio optimization as a symphony orchestra, each instrument plays a critical role, and strategic asset allocation ensures that all components work in harmony. This approach involves setting and maintaining targeted allocations for various asset classes, adjusting them as market conditions change, and tools like PortfolioPilot simplify the rebalancing process to ensure your investment goals are consistently met.

- Diversification Across Non-correlated Assets: Diversification is akin to a well-rounded diet. Just as we consume different nutrients to maintain health, investing in non-correlated assets ensures that your portfolio isn't overly reliant on any single economic condition. This approach is critical for mitigating risks and smoothing out investment returns over time.

- Risk Factor Investing: This method digs deeper into the underlying risk factors that drive returns across different assets. By identifying and understanding these factors, investors can make more informed decisions that align with their risk tolerance and return objectives.

- Utilization of Derivatives (Advanced): Derivatives like options and futures can be thought of as the protective gear in your investment toolkit. They can help shield your portfolio from potential downturns, acting as a form of risk management that preserves your capital against market volatility.

- Leveraging Technological Advances: The integration of AI and machine learning into investment strategies is transformative, allowing for a more nuanced analysis of vast data sets to predict market trends and inform decision-making.

Applying Strategies for Tangible Outcomes

While the strategies of asset allocation, diversification, risk management through derivatives, and leveraging technology are discussed theoretically, their real-world applications bring concrete benefits:

- Strategic Asset Allocation & Diversification: By regularly adjusting a portfolio to remain aligned with a strategic asset mix, many investors have mitigated losses during downturns and capitalized on growth in various sectors during upturns, particularly in emerging markets that may respond differently to economic cycles.

- Risk Factor Investing: Consider an investor focusing on specific sectors known for resilience during economic contractions, such as healthcare in 2020. This approach allowed them to not only protect their capital but also to see growth in a time when other sectors struggled.

- Utilizing Derivatives (Advanced): In practical terms, good use of derivatives have helped portfolios by hedging against sudden drops in stock markets. For example, options contracts can serve as insurance policies that pay off during unexpected downturns, thus preserving portfolio value.

- Leveraging Technological Advances: and have moved from merely trendy terms to crucial tools in portfolio management. Advanced algorithms can enhance the customization of investment strategies, meeting individual investor needs and reacting to changes in their financial landscapes, which may provide a significant improvement in investment outcomes.

Looking Forward

The future of investing is likely tied to the advancements in sustainable and impact investing, reflecting a broader shift towards integrating investment decisions with personal values and societal impacts. Embracing these elements within portfolio optimization not only serves financial goals but also aligns with a sustainable vision for the future.

Portfolio optimization is a dynamic and ongoing process. As markets evolve, so too should your strategies. With the support of tools as PortfolioPilot, you are well-equipped to adapt and thrive in the ever-changing investment landscape, ensuring that your portfolio not only meets your financial objectives but also contributes to a broader, more sustainable financial future.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: