What Is the Consumer Price Index?

%2520(1).webp)

Navigating the economic landscape requires a grasp on various indicators that can impact everything from your household budget to global markets. One such measurement, often discussed but sometimes misunderstood, is the Consumer Price Index. Let's explore what this index involves and consider its implications from an informed perspective.

Decoding the Consumer Price Index (CPI)

The Consumer Price Index, or CPI, measures the average prices paid by urban consumers for a standard market “basket” of consumer goods and services. This basket represents a wide range of items, including food, clothing, and medical services, which are crucial for daily life. It can be used for measuring price changes over time (i.e. inflation).

The Role of CPI in Economic Decisions

The CPI is not just a number; it's a tool used by policymakers and economists to guide economic strategy. Here are a few ways how:

- Tax Adjustments: It helps adjust the federal tax structure to counteract inflationary impacts.

- Social Security: Benefits are often adjusted based on CPI to maintain the beneficiaries' purchasing power.

- Monetary Policy: Central banks often use CPI data to make decisions about interest rates.

Peeking Into CPI Calculation

The process of determining the CPI involves several meticulous steps:

- Basket Definition: The first step is defining which goods and services are most representative of the average consumer's spending habits.

- Price Collection: Prices for these items are collected regularly. (monthly in the US)

- Base Year Establishment: A base year serves as a benchmark for comparison.

- Index Computation: The cost of the basket is compared over time, indexed to the cost in the base year.

Real-World Impact of the Consumer Price Index

While CPI data might seem abstract, it has tangible impacts:

- Personal Finance: For individuals managing investments, understanding how their assets perform relative to CPI can be insightful.

- Pricing Strategies: Businesses may adjust their pricing based on trends indicated by CPI to better align with consumer purchasing power.

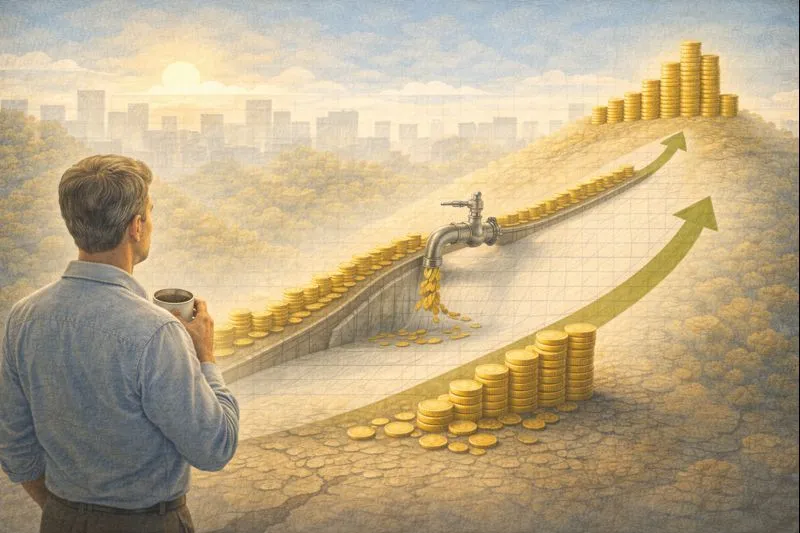

Reflecting on CPI and Your Portfolio

For those managing investment portfolios, insights from CPI trends might cause shifts in strategy. Commodities and real estate have historically benefitted during periods of high inflation, which could be indicated by a rising CPI, so understanding these nuances might inform one's decisions. We believe that a portfolio tracker or AI Financial Advisor integrating such economic indicators might offer enhanced insights for investment management. For instance, tools like PortfolioPilot offer tailored analytics and personal financial advice with macro context, helping align investment strategies with broader economic metrics.

Looking Ahead: CPI and Investment Strategy Integration

Looking ahead, the relevance of CPI in strategic financial planning will likely continue to play a significant role as we navigate future economic shifts. Enhancements in AI and analytics could allow for the integration of CPI into a holistic investment approach, potentially leading to more dynamic and responsive strategy formulation. As part of a broader financial knowledge base, the Consumer Price Index provides context that empowers smarter investment and policy decisions.

Understanding the Consumer Price Index is about more than numbers—it's about connecting the dots between economic indicators and personal financial health. In embracing tools that integrate this understanding, investors can better navigate the complexities of the investment landscape, making decisions that are informed by comprehensive, real-time economic insights. This proactive approach can be particularly beneficial in adapting to and potentially capitalizing on economic fluctuations.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: