A Guide to Investing for Beginners

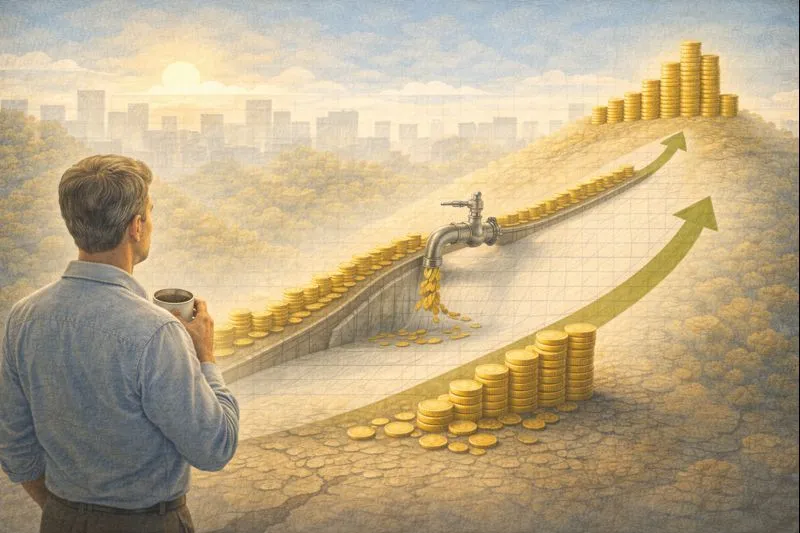

According to Allianz Life’s 2025 Q2 Quarterly Market Perceptions Study, nearly half of Americans (48%) say they’re currently too nervous to invest—up from 41% in Q1—and the highest level of investment anxiety since the question was first asked in 2019. The common perception is that successful investing requires advanced financial knowledge or market timing skills. In reality, wealth-building can often come down to consistent habits, simple strategies, and a long-term mindset.

This article unpacks the essentials of investing for beginners, explaining how to set clear goals, understand risk, select investment vehicles, and avoid common mistakes. By the end, readers will see that starting small and staying consistent is often more effective than chasing complexity.

Key Takeaways

- Setting clear goals and timelines is the foundation of any investment plan.

- Risk tolerance varies by age, income stability, and personal comfort with volatility.

- Diversification, compounding, and dollar-cost averaging are essential long-term tools.

- Beginners often stumble by overtrading or chasing hype-driven trends.

- Building wealth is less about predicting markets and more about disciplined consistency.

Setting Goals Before Choosing Investments

Successful investing begins with clarity. Some investors save for retirement in 30 years, while others hope to buy a house in five. These different timelines call for different strategies. Long-term goals can often accommodate more stock exposure, while short-term needs may favor bonds or cash equivalents.

- Hypothetical: Imagine a 30-year-old professional saving for retirement. With three decades ahead, this investor can weather short-term volatility in pursuit of growth. By contrast, a 55-year-old preparing for college tuition in five years may prioritize stability over returns.

So what? Defining timelines and goals can help determine not only what to invest in, but how much risk is reasonable.

Understanding Risk Tolerance

Risk tolerance isn’t just about personality—it’s about financial reality. A person with a stable income and emergency savings may be more willing to accept volatility than someone living paycheck to paycheck.

Common indicators of risk tolerance include:

- Time horizon (years until funds are needed)

- Income stability (consistent salary vs. variable gig work)

- Emotional comfort (ability to handle market swings without panic-selling)

Vanguard’s behavioral analysis reveals the disposition effect: investors disproportionately sell assets that have gains rather than those that have losses. Recognizing one’s true risk tolerance can help avoid reactive decisions that derail long-term plans.

Choosing Between Stocks, Bonds, and ETFs

For beginners, the investment universe can feel overwhelming. At its core, most portfolios revolve around three building blocks:

- Stocks: Ownership in companies generally offers higher potential returns with higher volatility.

- Bonds: Loans to governments or corporations, often lower risk but lower growth.

- ETFs (Exchange-Traded Funds): Baskets of stocks or bonds that trade like individual shares, providing diversification in a single purchase.

Historically, combining these assets has helped smooth out returns. For example, during the 2022 rate-hike cycle, both stocks and bonds fell together—a reminder that even “balanced” portfolios face risks. But over long periods, mixing assets often reduces the chance of catastrophic losses.

Avoiding Common Pitfalls

Beginners often make predictable mistakes. These include:

- Overtrading: Buying and selling too frequently, incurring taxes and fees.

- Following hype: Jumping into trending stocks or “hot tips” without due diligence.

- Ignoring fees: Over time, high expense ratios can eat away at growth.

A disciplined approach—such as dollar-cost averaging (investing the same amount at regular intervals) helps sidestep emotional decision-making. Compounding works best when investors stay consistent rather than chase quick wins.

Building a Long-Term Mindset

Diversification, compounding, and dollar-cost averaging are not just technical terms—they are behaviors that shape outcomes.

- Diversification spreads investments across asset classes and sectors.

- Compounding reinvests gains to accelerate growth over time.

- Dollar-cost averaging reduces the impact of short-term volatility by spreading out purchases.

The real lesson? Wealth tends to grow for those who stay invested through market cycles, not for those who attempt to time them.

Beginners don’t need to master every market detail. What matters most is setting goals, respecting risk, and committing to consistent, long-term behaviors. A simple portfolio held with discipline often outperforms complex strategies abandoned midway.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: