Dividend Stock Comparison: Find the Best Income-producing Stocks

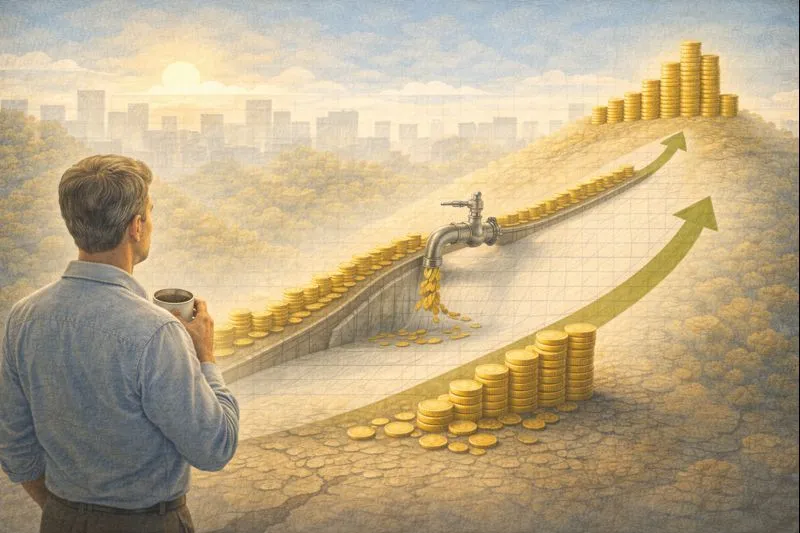

Dividend stocks can help you earn steady income while growing your wealth—here's how. Whether you're just starting out or looking to optimize your portfolio, dividend stocks offer a reliable way to create passive income while benefiting from long-term growth. This guide will walk you through how to compare dividend stocks, choose the best ones for your needs, and understand why these steps matter for your financial goals.

Key Takeaways

- The Benefits of Dividend Stocks: Understand how dividend stocks provide steady income, act as a cushion during market volatility, and offer long-term growth through reinvestment.

- Key Metrics for Evaluating Stocks: Explore how to analyze dividend yield, payout ratios, dividend growth, and stability to identify reliable and sustainable options for your portfolio.

- Steps to Build a Strong Portfolio: Learn how to define your goals, compare stock metrics, and diversify across sectors to create a balanced approach that fits your financial needs.

- Avoid Common Pitfalls: Be aware of risks like chasing unsustainable high yields, focusing solely on dividends instead of total return, overlooking the importance of growth, or neglecting tax implications that can impact your returns.

Why Dividend Stocks Are a Smart Choice

Dividend stocks are unique because they pay you just for holding them. These regular payouts can be a game-changer, especially during uncertain markets or as you approach retirement. Here's why they deserve a spot in your portfolio:

- Steady Income: Dividend payments provide a consistent cash flow, whether you're reinvesting them or using them to cover expenses.

- Growth Potential: Companies that regularly increase dividends can help protect your purchasing power against inflation.

- Stability: Dividend-paying companies are often well-established businesses with solid financials, often reducing the risk of big losses during market downturns.

If you're building a portfolio in a volatile market, dividend stocks act like the steady anchor, keeping you in one place while other investments might fluctuate more drastically.

Understanding the Basics: What Are Dividend Stocks?

Dividend stocks are shares in companies that pay part of their profits to investors. These payouts, called dividends, often occur quarterly and are typically expressed as an annual dollar amount or percentage of the stock price.

Why They Matter:

Imagine you're holding a $100 stock that pays $5 in annual dividends. That’s a 5% return on your investment before any potential stock price increases or decreases. Over time, this steady income can add up—especially if you reinvest your dividends to buy more shares.

Dividend-paying companies are often established players in industries like consumer goods, utilities, or real estate, where demand tends to stay consistent even during economic slumps.

How to Compare Dividend Stocks (And Why It’s Important)

Not all dividend stocks are created equal, and choosing the wrong ones can lead to lower returns or unnecessary risks. Here are the key factors to evaluate:

1. Dividend Yield

The dividend yield shows how much a company pays in dividends relative to its stock price.

- Why It Matters: A higher yield might look attractive, but it can sometimes signal trouble. For example, if a company’s stock price has dropped sharply due to financial struggles, the yield might appear unusually high—but it’s not sustainable.

Think of it this way: A 4% yield from a solid, growing company is often better than a 10% yield from a business on the brink of collapse.

2. Payout Ratio

The payout ratio is the percentage of a company’s earnings used to pay dividends.

- Why It Matters: A sustainable payout ratio (typically below 60%) shows the company has room to grow dividends or reinvest in the business. If the payout ratio is too high (e.g., 90%), it might not have enough profit left to weather downturns or fund future growth.

3. Dividend Growth

Companies that regularly increase dividends show resilience and financial health.

- Why It Matters: Growth-focused dividends help protect you from inflation and boost your income over time. We recommend looking for stocks with at least 5-10 years of consistent increases.

4. Dividend Stability

A stable dividend history is a sign of reliability, especially during economic downturns.

- Why It Matters: Companies in sectors like utilities or consumer staples (e.g., electricity providers or grocery suppliers) tend to have consistent payouts because their products and services remain in demand regardless of market conditions.

Step-by-Step Guide to Choosing Dividend Stocks

Here’s how to find the best dividend stocks for your goals:

1. Define Your Goal

Are you looking for income now or long-term growth? For immediate income, prioritize high yields. If growth is your goal, look for stocks with lower yields but higher dividend growth rates.

2. Make a List of Potential Stocks

Start with well-established, reliable companies that have a proven track record of consistently paying dividends. Look for businesses with a strong history of financial stability and consistent performance across various economic cycles.

3. Compare Metrics

Instead of relying solely on yield, evaluate a combination of:

- Yield: Is it attractive but not too high?

- Payout Ratio: Is it sustainable?

- Growth: Does the company increase dividends regularly?

Example Comparison:

- Company A: Yield of 4%, payout ratio of 60%, 5-year growth rate of 3%.

- Company B: Yield of 3%, payout ratio of 40%, 5-year growth rate of 7%.

- Company C: Yield of 5%, payout ratio of 90%, no dividend growth.

If you're looking for a mix of stability and growth, Company B might be your best fit. For higher income now, Company C might look appealing but carries more risk.

4. Diversify Across Sectors

Don’t just invest in one sector. You could combine stable sectors like utilities with growth-oriented ones like technology to balance risk as part of a diversified portfolio.

Avoid These Common Mistakes

Chasing High Yields

Don’t be tempted by extremely high yields without checking the company’s financial health. Sometimes, these companies are struggling and may cut dividends.

Ignoring Dividend Growth

A high yield today won’t matter if the dividend doesn’t grow over time. Growth is key to outpacing inflation.

Overlooking Taxes

Dividends are taxable unless held in tax-advantaged accounts like Roth IRAs. Make sure to account for this in your planning.

Focusing Solely on Dividends Instead of Total Return

Dividends may seem like “free money,” but they’re not a bonus on top of the stock’s performance. When a company pays dividends, its stock price typically decreases by the same amount, reflecting the payout. Focusing only on dividends without considering the stock's overall price performance can lead to missed opportunities for better total returns.

How optimized is your portfolio?

PortfolioPilot is used by over 40,000 individuals in the US & Canada to analyze their portfolios of over $30 billion1. Discover your portfolio score now: